IRS Form 1098-T and Education Tax Requirements

Find Your Account Details:

- How to View Your Payment History

- How to Access Your Full Account Summary

- How to Access Your Form 1098-T Calculations

Important Information regarding payments: Please allow at least 10 business days for a mailed payment to reach our office. Payments from 529 plans may take longer than 10 business days to reach our office for processing.

Payments mailed through the US Post Office on or before December 5, 2025 should be received by December 19, 2025 and will be posted to your account in calendar year 2025.

Payments received after December 19, 2025, may not be posted to the student’s account in the current year due to the necessary processing time before the University closure on December 24, 2025 through to January 1, 2026.

Electronic payments made via Web Check through the Payment Center on the Online Hofstra Portal will continue to be processed on the student’s account on the date the payment is made. Therefore, a Web Check that is completed through the Payment Center on December 30, 2025, will be reported on the current year 1098-T.

With the spring tuition bill due the first week in January 2026, please consider the due date as well as the IRS regulations when determining whether to pay your spring 2026 bill before or after December 31, 2025. Please consult with your tax advisor before making this decision or view the IRS website below.

Beginning with tax year 2018 and later, the amount in Box 1 is qualified tuition and related expenses (QTRE) paid during the year up to a maximum of QTRE billed during the calendar year plus carryover amounts of unpaid QTRE from prior years.

2017 1098T Reporting and Prior: Hofstra University reported in Box 2 the QTRE billed to your student account for the calendar (tax) year. Box 1 was blank for all students.

Depending on the taxpayer’s income, whether the student is considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. You can find detailed information about claiming education tax credits in IRS Publication 970.

Information reported on your Form 1098-T, in addition to your payment records, may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim on your tax return.

Hofstra University is unable to provide you with individual tax advice; you should seek the counsel of an informed tax preparer or adviser.

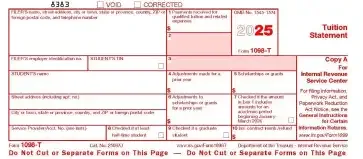

Below is a blank sample of the 2025 Form 1098-T, which you will receive by January 31, 2026, for your general reference. See the PDF for more information about Form 1098-T.

Printing your form and supporting documents:

- Adobe Acrobat is required to print your 1098-T from the Payment Center.

- You can print your 1098-T and details for each amount reported from the Hofstra Portal under Student Accounts, then Tax Notification.

- Clear your browser history if you experience problems.

Form 1098T FAQ

- Q1. I just received a Form 1098-T. What is this form?

-

A1. Universities and colleges are required to issue the Form 1098-T Tuition Statement to aid in determining a student's eligibility for the American Opportunity Credit and Lifetime Learning education tax credits. For more information on these tax credits, please refer to the IRS web site. The Form 1098-T is informational only. It is used by eligible educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997. Eligible educational institutions are required to submit the student's name, address, and taxpayer’s identification number (TIN), enrollment and academic status. Beginning with 2018, educational institutions must also report to the IRS amounts paid toward qualified tuition and related expenses, as well as scholarships and/or grants, taxable or not.

Form 1098-T is prepared each year by the end of January 31st for those students who had reportable transactions in the preceding calendar year. It should not be considered as tax opinion or advice. Please give this form to your tax preparer to help determine if you are eligible for any tax credits. - Q2. What to do with Form 1098-T?

-

A2. The information on the form, along with your payment records, will help determine if you may claim the American Opportunity or the Lifetime Learning education tax credits.

- Q3. How do I receive a copy or reprint my lost Form-1098-T?

-

A3. A copy of your Form 1098-T will be available on the Hofstra Portal by January 31st if you had reportable transactions in the previous calendar year. You can also print a copy through the Hofstra Portal at my.hofstra.edu. Simply log on to the Portal and view or print your electronic form in the Payment Center. To view forms for tax years before 2015 log onto the Portal, then under Student Services go to Student Accounts, then choose Tax Notification. For more detailed instructions select the link here How to Access Tax Information (1098-T).

- Q4. The Social Security (SSN) or Individual Taxpayer Identification Number (ITIN) on my Form 1098-T is missing or incorrect. What should I do?

-

A4. Reporting to the IRS depends primarily on your SSN, so it is very important for you to have the correct information on file with the University. Please complete Form W-9S which can be printed from the link here Bursar W9S or the IRS Web site and submit Form W-9S along with a copy of your Hofstra ID to the Office of Academic Records, located in 207 Memorial Hall to ensure the data we send to the IRS is accurate.

- Q5. Why is the amount in Box 1 different from my records?

-

A5. Beginning with 2018 amounts paid toward qualified tuition and related expenses are reported in Box 1. Amounts reported in Box 1 are capped at the amount of Qualified Tuition and Related Expenses posted to your account in the calendar year. View the IRS information at IRS FAQ about Education Credits to help determine the Education Credit you may qualify for on your tax return. For tax years before 2018, Box 1 will be blank for all Hofstra students. To review all payments and other credits applied to your account during the year, please access your account at my.hofstra.edu.

How to View Your Payment History

How to Access your Full Account Summary

How to Access your Form 1098-T calculationsNote: Before 2018, Hofstra reported amounts billed for qualified tuition and related expenses in Box 2.

- Q6. Where can I find my Hofstra payment history?

-

A6. You can access the payment details of your account using the Hofstra Portal. You should reference your statements and your banking records for the most complete information regarding payments you made to Hofstra.

How to View Your Payment History

How to Access your Full Account Summary

How to Access your Form 1098-T calculations - Q7: What does an amount in Box 4 mean?

-

A7. Box 4 - Adjustments made for a prior year show an amount if payments that were reported on a 1098-T for a prior year were subsequently adjusted or reduced in the current tax year.

- Q8: What does an amount in Box 5 mean?

-

A8. Box 5 - Scholarships or grants shows the net amount of certain forms of educational assistance that was received or applied to your student account during the tax year (January - December).

- Q9. What does an amount in Box 6 mean?

-

A9. Box 6 - Adjustments to Scholarships or grants for a prior year shows an amount if scholarships or grants that were reported on a 1098-T for a prior year were subsequently adjusted or reduced in the current tax year.

- Q10. What does an amount in Box 8 mean?

-

A10. Box 8 - Check if at least half-time student, if checked, indicates that you were considered to be enrolled at least half-time for one or more terms during the tax year.

- Q11. What does the check mark in Box 9 mean?

-

A11. Box 9 - Check if graduate student…, if checked, indicates that you were enrolled in a graduate program for one or more terms during the tax year. The University checks this Box if you attended as a graduate student for any term of your enrollment during the tax year.

- Q12. Do I need to report my scholarships as taxable income?

-

A12. Scholarships that pay for qualified tuition and related expenses are not taxable to the student. However, if any portion of your scholarships paid for non-qualified expenses, then you may be responsible for reporting such portion as taxable income on your tax return. Hofstra University is unable to provide you with individual tax advice. You should consult your tax advisor. For further guidance, please review IRS Publication 970, 'Tax Benefits for Education' at the IRS Web site.

- Q13. How are late fees reported on my Form 1098-T?

-

A13. Fees charged for late registration and/or late payment are non-qualified expenses, and are not reported anywhere on your Form 1098-T.

- Q14. I graduated in May. Why didn't I receive a Form 1098-T?

-

A14. If you graduated in May,it is possible your spring term charges were billed in the prior year. You can view details of the amounts on your form on the Hofstra Portal. If you need to access amounts paid, you can reference your own banking information or the Hofstra Portal at my.Hofstra.edu for account detail information. Provide all details to your tax preparer to help determine your Education Credit eligibility.

- Q15. What does the check mark in Box 7 mean? Why are amounts for the January or Spring term included on the form?

-

A15. Included on your current year Form 1098-T may be January/Spring term payments if they were recorded on your account prior to December 31.

- Q16. How can I Opt Out of a paper 1098T Form?

-

A16. For the most secure method of accessing your form, elect to receive it electronically and eliminate a paper form in the mail. For detailed instructions select the link here How to Opt Out of a Paper Form 1098T.

For additional information, please consult the following:

- IRS Web site

- Internal Revenue Service: 1-800-829-1040